After 171 Boeing 737 Max 9 aircraft were stopped and inspected after a door collapsed mid-flight, the Federal Aviation Administration (FAA) now indicates it is investigating the “manufacturing practices” of the US planemaker and its subcontractor Spirit AeroSystems.

there Angolan Armed Forces The announcement was made as part of an update on steps taken since the January 5 incident with Alaska Airlines Flight 1282. Spirit AeroSystems is the vendor that builds and installs the board that flies into the air.

The organization that regulates and monitors civil aviation in the United States indicates that it particularly wants this Review potential system changes

. The investigation will be conducted with the National Transportation Safety Board.

there Angolan Armed Forces It also notes that it has completed the first phase of 40 inspections and must now review the data collected.

All 737 MAX 9 aircraft equipped with the same door system will remain on the ground awaiting review by the jury Angolan Armed Forces And final approval of the inspection and maintenance process that meets all safety requirements.

Once this inspection and maintenance process is approved, each grounded aircraft must be evaluated before being returned to service. Public safety, not speed, will determine the timeline for these planes to return to service

he concludes Angolan Armed Forces.

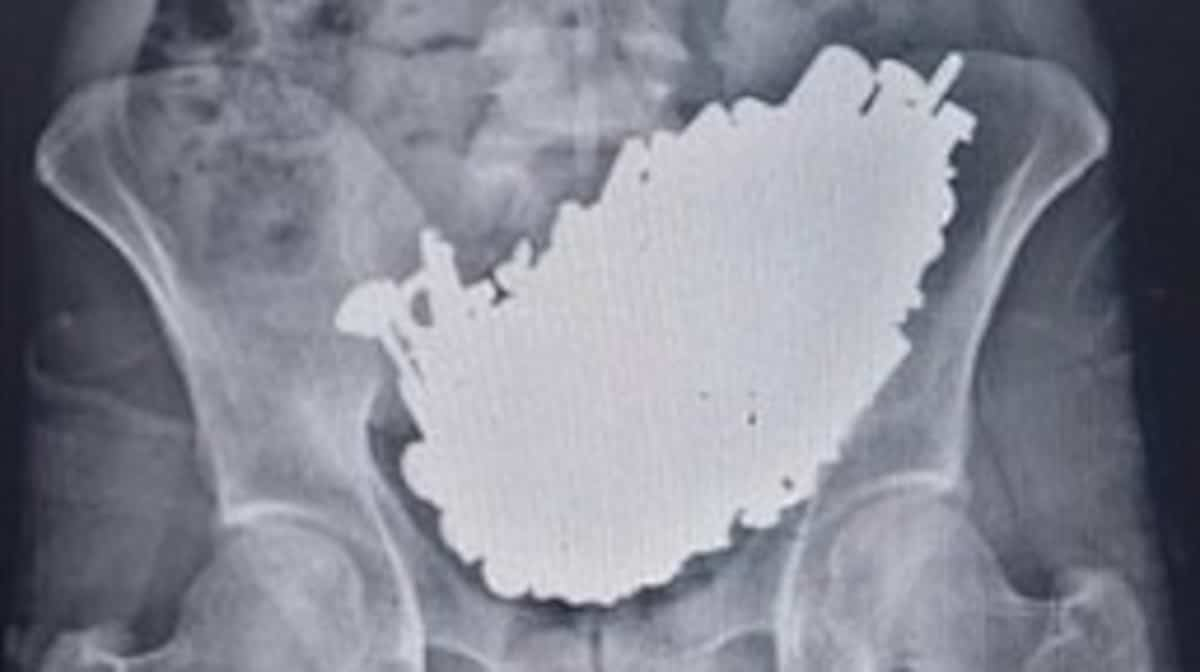

According to many specialists who have seen this model, especially the specialized site manager Air current

John Ostrower, The MAX 9 appears to have a blocked door and is hidden by a partition that only reveals an opening, which may have been the cause of the accident.

For his part, aviation specialist Xavier Titelman believes that this incident could reveal a flaw in the design of the device and not a problem related to maintenance.

Financial turmoil

Boeing stock has reached its lowest level in two months, having lost nearly 20% since the accident, which caused no losses.

An FAA review by Wells Fargo warned Tuesday It will open a whole new can of worms

Multiple consequences can be expected.

Wells Fargo downgraded Boeing shares in part due to a slowdown in planned 737 MAX deliveries in 2024, which will reduce free cash flow by $2 billion.

With information from Reuters and Agence France-Presse