A Central Valley congressman is reaching out to the IRS based on KCRA’s ongoing investigation into fraudulent claims with the California Employment Development Administration, or EDD. “The right people don’t get benefits fast enough; the wrong people get paid instead,” says Modesto Congressman Josh Harder. “Today, it is clear that victims of identity theft may be hit with a tax bill in exchange for benefits they never received. My frustration with this agency is endless. Obviously, we need top-down reform.” Harder is furious with California EDD and worried about identity theft victims and what might await them. This comes after KCRA told Harder that tax documents generated by EDD could be sent to many of these victims. Harder moved quickly, sending a letter to the IRS. “My letter to the IRS is really about discovering two things,” Harder said. First: Are they aware of this problem? And second: What is their proactive plan to help people who have been victims of identity theft, so that these victims do not end up imposing a tax liability on benefits they never received in the beginning somewhere? This is incredibly cruel, no Sima in the midst of a crisis like the one we see today. “The tax implications were first brought to KCRA three months ago by Mollie Battle.” Next year, when it’s time to file taxes or whatever they’ll say, “Oh, we paid you $ 21,900, And I’ll be responsible for it, ”Patel said from her home in North Carolina.“ So this is one reason I’m trying to get all the help I can get right now. ”The fight is one of the thousands, perhaps millions of names that have ended up on piles of The letters began appearing in California mailboxes last summer. All letters have real names and real identities from all over the country An investigation by KCRA 3 found that personal information of people across the country was stolen in data breaches and then sold on the dark web. What People, or even foreign crime gangs, use them in the names of others, send envelopes to California addresses, and intercept envelopes. Majority have pre-loaded EDD debit cards. KCRA 3 investigators contacted EDD to ask whether management separated the fraudulent and legitimate claims before the tax forms were submitted. They replied, “We are continuing to work on messaging about the annual Form 1099G process and will follow up with more information as we go through January.” People who get paid through EDD will still have to pay taxes on that as income. EDD announces this to the IRS with a model called 1099-G, according to Daun Jang, an associate professor of Sacramento State. “If they mistakenly send a Form 1099-G to victims of identity theft, they should submit a corrected Form 1099-G,” said Gang. “And I think doing that is the people who got this Form 1099 and didn’t actually receive the benefits that they have for reporting fraud on the websites of those state governments.” This means that consumers will have to file a fraud claim through EDD, and people across the country have told KCRA that filing a claim is difficult at best, and while Congressman Harder cannot control how EDD works, he said he can educate the IRS that Congress wants them to act now to prevent victims of identity theft from becoming victims of identity theft everywhere again. “There are millions of fraud cases across the state of California. EDD couldn’t even come up with a good estimate,” said Harder, “because they are unable to distinguish between those legitimate cases and those fraud cases. I think it will be rampant. Thank you so much for raising this issue. “The IRS says cases proven to be identity theft shouldn’t even get a Form 1099-G. If you got an account from a fraudulent account, EDD will have to file another showing an amount of zero in dollars, which means, again, you will have to file a fraud claim with EDD. One agency working to alleviate this problem is the Beverly Hills Police Department. It is one of the few law enforcement agencies to make major arrests for this fraud. They are now starting to track down all the people whose names were in the seized envelopes. They have an IRS investigator working with them, just in Beverly Hills, they say they’ve verified thousands of victims, if you need help with EDD or get one of the IRS 1099-G forms, state lawmakers say call them if you can’t access EDD. Lawmakers are working with local members of Congress to clarify the issues that were happening.

A Central Valley congressman is communicating with the IRS based on KCRA’s ongoing investigation into fraudulent claims with the California Employment Development Administration, or EDD.

“The right people aren’t getting benefits fast enough; the wrong people get paid instead,” says Modesto Congressman Josh Harder. “Today, it is clear that victims of identity theft may be hit with a tax bill in exchange for benefits they never received. My frustration with this agency is endless. Obviously, we need top-down reform.”

Harder is furious with California EDD and worried about identity theft victims and what might await them. This comes after KCRA told Harder that tax documents generated by EDD could be sent to many of these victims.

The most difficult moved quickly, and sent a letter to the IRS.

“My letter to the IRS is really about discovering two things,” said Harder. First: Are they aware of this problem? And second: What is their proactive plan to help people who have been victims of identity theft, so that these victims do not end up imposing a tax liability on benefits they never received in the beginning somewhere? This is incredibly cruel, especially In the midst of a crisis like the one we see today. “

Tax implications were first brought to KCRA three months ago by Mollie Battle.

“Next year, when it’s time to file taxes or whatever they’ll say, ‘Oh, we paid you $ 21,900, and I’m going to be responsible for that,'” Patel said from her home in North Carolina. “So this is one reason I’m trying to get All possible help now. “

Patel is one of thousands, possibly millions of names that ended up on piles of letters that began appearing in California mailboxes last summer. All messages have real names and real identities from all over the country.

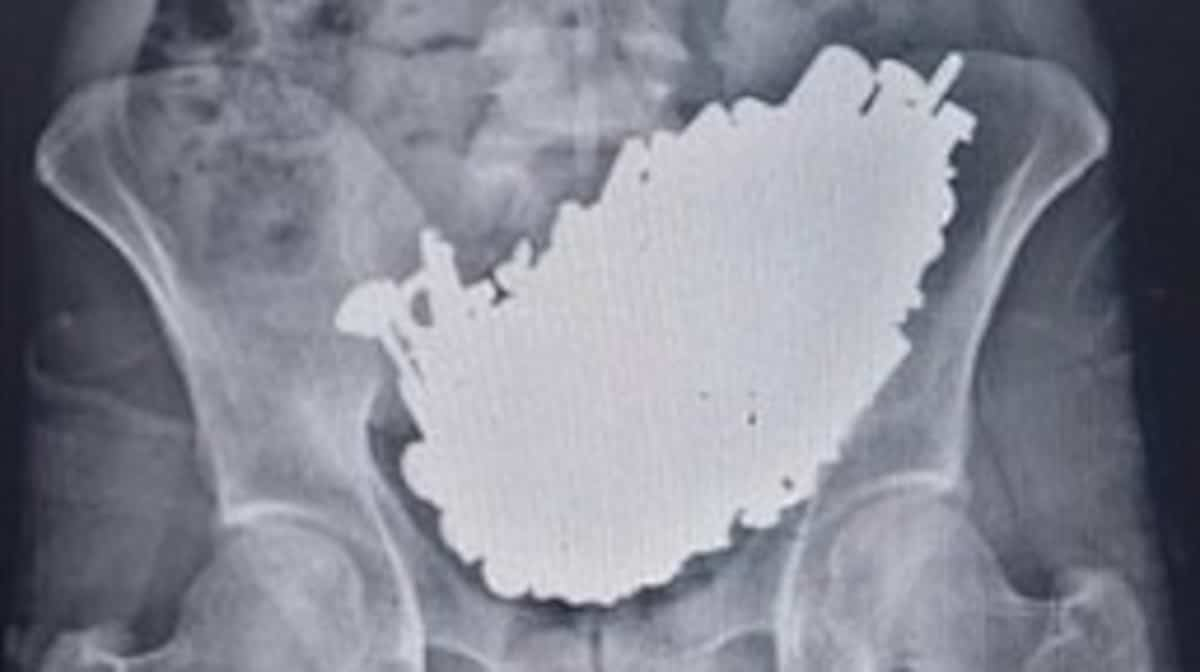

An investigation by KCRA 3 found that personal information of people across the country was stolen in data breaches and then sold on the dark web. Often used by individuals, or even foreign crime gangs, they are used in other people’s names, send envelopes to California addresses, and then intercept envelopes. Majority have pre-loaded EDD debit cards.

KCRA 3 investigated EDD contacted to ask whether management separated the fraudulent and legitimate claims before the tax forms were submitted. They replied, “We are continuing to work on correspondence about the annual 1099G process and will follow up with more information over time in January.”

People who get paid through EDD will still have to pay taxes on that as income. EDD announces this to the IRS with a model called 1099-G, according to Daun Jang, an associate professor of Sacramento State.

“If they mistakenly send a Form 1099-G to victims of identity theft, they should submit a corrected Form 1099-G,” said Gang. “And I think doing that is people who get these 1099 forms and have not actually received the benefits that they have for reporting fraud on the websites of those state governments.”

This means that consumers will have to file a fraud claim through EDD, and people across the country have told KCRA that filing a claim is Difficult perfect.

While Congressman Harder cannot control how EDD works, he has said he can sensitize the IRS that Congress wants them to act now to prevent victims of identity theft from falling victim to again.

Harder said, “There are millions of fraud cases across California, EDD couldn’t even come up with a good estimate, because they are unable to distinguish between those legitimate cases and these fraud cases. So I think it will rampant. Thank you very much for raising this issue.”

The IRS says cases proven to be identity theft should not even get a Form 1099-G. If you got an account from a fraudulent account, EDD will have to file another that shows a zero dollar amount, which means, again, that you’ll have to file a fraud claim with EDD.

One agency working to alleviate this problem is the Beverly Hills Police Department. It is one of the few law enforcement agencies to make major arrests for this fraud. They are now starting to track down all the people whose names were in the seized envelopes. They have an IRS investigator working with them.

Only in Beverly Hills did they say they verified thousands of victims.

If you need help with EDD or get one of the IRS 1099-G forms, state lawmakers say contact them if you don’t have access to EDD. Lawmakers are working with local members of Congress to clarify the issues that were happening.